Why Valyrian

- HOME

- Why Valyrian

Why Valyrian

The decision of who to entrust with the management of your hard-earned wealth is of the utmost importance. Any potential wealth manager needs to be judged on the following three key criteria.

- The security of my investments.

- The capability and experience of those making investment decisions

- The alignment of interest of the manager with the client’s goals

Valyrian Wealth has been set up to provide clients with comfort that these criteria are met.

Asset Security

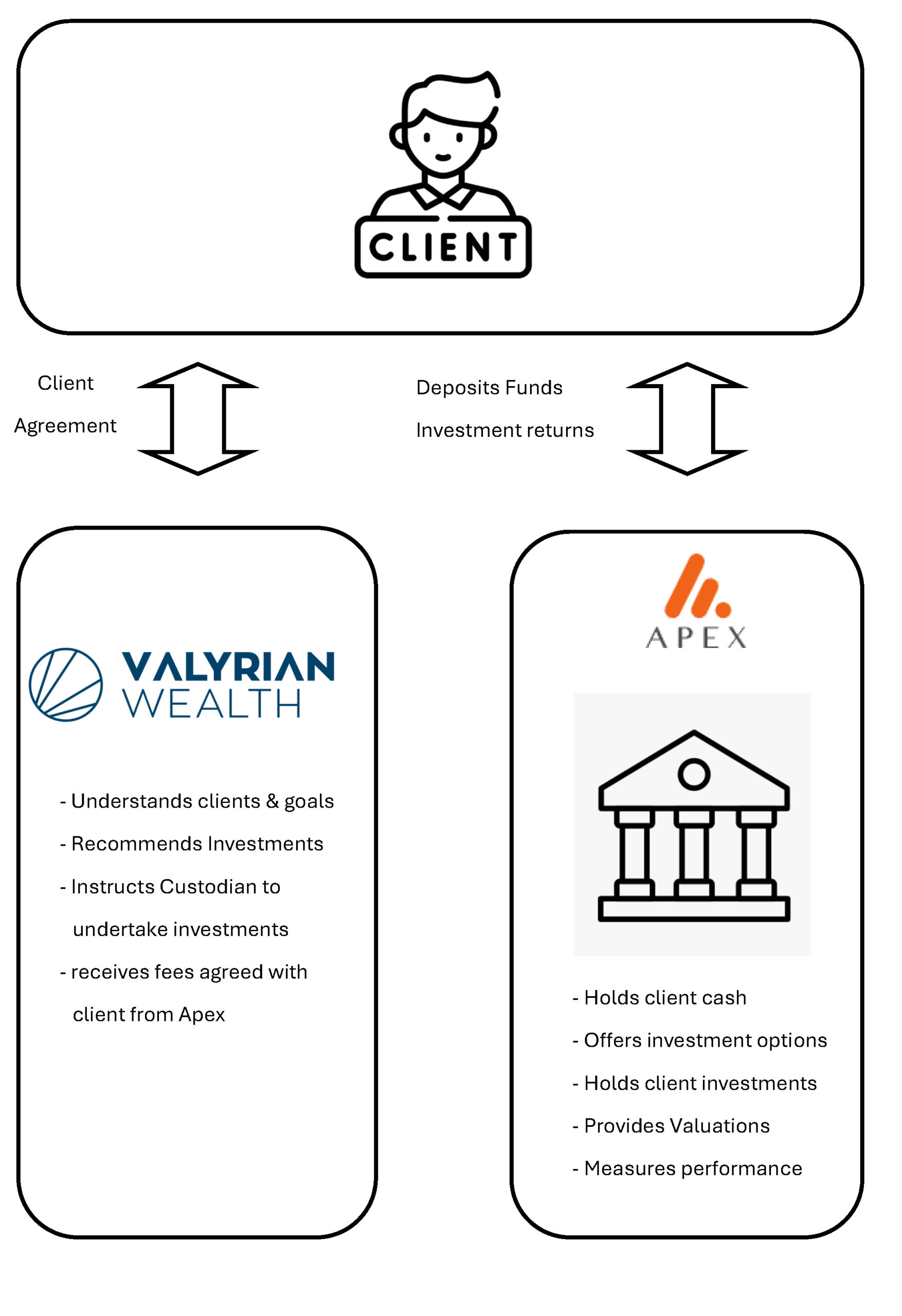

The security and transparency of where your assets are held and their updated valuation are paramount in any investment activity. All investments managed by Valyrian Wealth are held by a separate custodian, Apex Group, which holds the assets in trust for clients. When you make your investment, your funds are deposited with the Apex group. Apex has an approved list of financial products in which Valyrian can invest your funds. Withdrawals from the Apex account can only be to your bank account as specified. The only other allowed withdrawals are withholding tax deductions when required and the level of fees as agreed to in your client agreement with Valyrian Wealth.

Furthermore, the Apex group provides an up-to-date independent valuation of your assets to give you confidence in knowing how you are tracking towards your investment goals. Clients can log in to their accounts online to see updated valuations and receive regular statements with updated values.

Apex Group is the largest Custodian company in New Zealand, with assets administered totalling over $100 Billion NZD. The Apex companies, including MMC, have serviced the New Zealand market since 2005 and are the custodians of choice by many well-known investment firms. By having Valyrian manage your wealth, your assets are held as securely as they would be with many of the large investment advisors. Apex Group is regulated by the Financial Markets Authority of New Zealand.

For more information about the Apex group and MMC see https://www.mmcnz.co.nz/

Manager Capability

Valyrian Wealth Managing Director Darron Mitchell has first-hand experience in investment markets gained in some of the world’s most significant financial centres. In managing investment funds, Darron has deep expertise in understanding how markets work and what sort of investments work well in different market conditions. Darron’s training as a CFA and CA, combined with his experience in investment roles, has provided him with a skillset to analyse both individual companies and investment funds that collectively manage money.

With Darron’s skill and expertise in selecting stocks, clients can enjoy the benefit of direct investments rather than having to incur another level of fees to have exposure to that asset class. Having worked on the front line of the investment markets, Darron has seen how unnecessary costs and inefficiencies can be transferred to clients. These costs, while seemingly small each time, can add up significantly over the years. Your wealth manager should be a guardian to minimise these costs to help produce a better long-term investment result.

Darron’s capability and experience set Valyrian apart from many investment advisors.

For Darron’s career history, please see People Page.

For more information on the CFA qualification see: https://www.investopedia.com/terms/c/cfa.asp & https://www.cfainstitute.org/en/

Alignment of Values

Valyrian Wealth is an independent wealth manager, and it’s important to understand how significant that is to clients. Valyrian wealth has no association with any particular group of fund managers. There are wealth advisory firms that have some ownership of fund management groups or have those groups as major clients and, in some cases, both. In these situations, there is potential for a conflict of interest between those groups and the wealth management clients they service.

A wealth manager with an ownership interest in an investment fund may have an incentive to recommend that fund, perhaps over funds that are better suited to you. Where a wealth manager has clients that are large fund managers, there may be situations where they recommend that you buy investments sold by those large clients. Chances are those large clients may pay more fees to the wealth manager than you!

At Valyrian Wealth, our independence allows us to select investment products that are best for you based on your investment objectives and risk tolerance. The client-first principle is designed to give you the best outcome, and by achieving this, we will grow our own business. We only work for wealth management clients and not the sellers of other financial products, making your goals a priority in investment selection.

For more information on conflicts of interest that can exist in the industry, see:

https://rpc.cfainstitute.org/en/policy/positions/conflicts-of-interest